With near record levels of letting and investment activity in London in 2014, and with the City of London particularly active, it comes as no surprise that the saga of another EC3 asset is moving to a conclusion.

Recent reports indicate that 80 Fenchurch Street, EC3, is now under offer. Partners Group, a Swiss based private investment management company, has agreed terms to buy the scheme out of receivership for a rumoured sum of £50 million. There was bidding competition for ownership of the site and completion of the sale will conclude an ongoing struggle concerning the development which has been continuing since 2012.

The 80 Fenchurch Street site covers an area of 0.6 acres and is thought to represent a development opportunity worth in the region of £300 million. Planning consent for a 245,182 sq ft office building designed by Fosters and Partners has already been granted. With the constraints on City of London office supply predicted for some time, a new development of this scale in the heart of the City insurance district may attract keen pre-let interest from occupiers.

The proposed scheme continues the ongoing transformation of Fenchurch Street, one of EC3’s main thoroughfares. With completed/proposed developments including the Rafael Vinoly designed 20 Fenchurch Street, the 420,000 sq ft Generali led 120 Fenchurch Street and TIAA Henderson’s Leadenhall Triangle scheme, Fenchurch Street seems set to gain increasing allure.

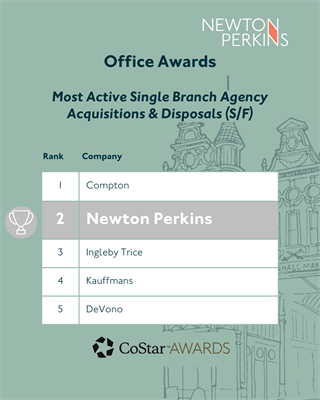

Newton Perkins have been particularly active within the vicinity in recent weeks, having let 2 floors and placed a 3rd under offer at AIK’s comprehensively refurbished 140 Fenchurch Street. AIK welcome Hua Nan Commercial Bank and Harman Kemp to the building, which was previously occupied in its entirety by AXA.

The building has been extensively refurbished throughout, including a remodelling of its reception, which now incorporates the alluring feature ‘watchstrap’ wall.

AIK will be delivering 3 further floors to the market in Q1 2016. Please call Jamie Nurcombe or Chris Sutcliffe for further information.

For further discussion, please contact David Alcock or Harry Trotter.